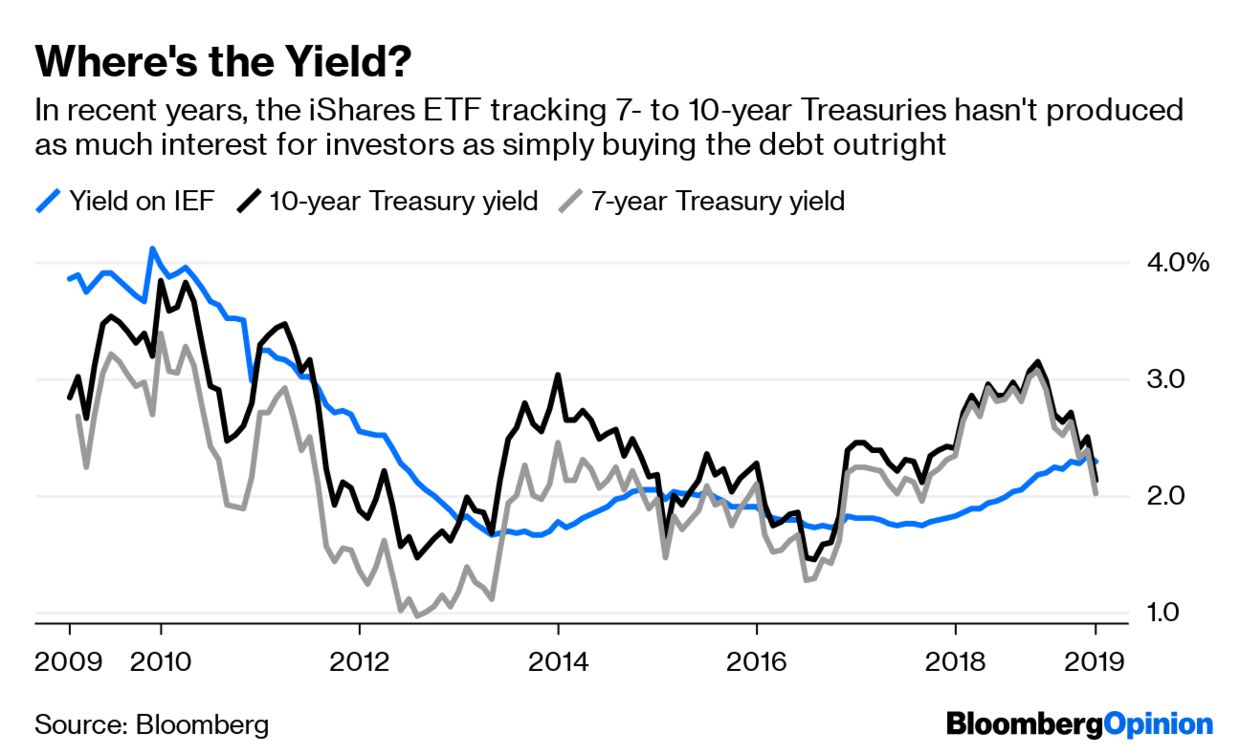

“We're going to see dramatic and large inflows into fixed income over the next year as interest rates rise,” Kapito said. Treasury Bond ETF (GOVT) and the iShares 7-10 Year Treasury Bond ETF (IEF) pulled in more than $16.2 billion alone, according to ETF.com data. In the last quarter, the iShares 20+ Year Treasury Bond ETF (TLT), the iShares U.S. Fixed income advisory fees remained relatively steady, at $273 million. Investment advisory fees for equities from iShares came in at nearly $1.1 billion, beating analyst expectations of $992 million. “The combination of bonds and infrastructure is going to present some great fixed income outcomes for our investors.” is going to create significant opportunities for long-term investors and infrastructure to add returns to portfolios,” he said, according to a transcript. “Infrastructure and sustainability stimulus in the U.S.

Treasury Bond ETFCboe Consolidated Listings:GOVT. iShares 7-10 Year Treasury Bond ETF Symbol Symbol Holding Holding Assets Assets N/A: United States Treasury Notes 1.375 1: 19. ETF Database Categories Head-To-Head ETF Comparison Tool.

#Ishare bond etf for free#

Inflows into fixed income funds is a lasting trend, BlackRock President Rob Kapito said on an earnings call. Search ETFs and view performance, ratings and risk, portfolio allocation, charts and more. Explore IEF for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. Nearly $1.5 billion was brought in from credit and active fixed income flows. Inflows were primarily driven by bond ETFs, which generated $37 billion of net inflows-the second best quarter in the firm’s history-as continued market volatility from inflation, rising rates and geopolitical uncertainty forced investors into the asset class. While that wasn’t quite half of last year’s $58 billion, the unit collected more fees than expected. However, the stall in revenue growth was partially offset by net inflows from ETFs, with third quarter inflows coming in at $22 billion. iShares Short Treasury Bond ETF 109.91 SHV0.0091 Invesco Solar ETF 66.89 TAN3.23 Vanguard Short-Term Treasury Index Fund ETF 57.73 VGSH0.12 Vanguard Sht-Term Inflation-Protected Sec Idx ETF. For example, one source found that, on average, high-yield corporate bonds trade fewer than half the days each month meanwhile, the iShares iBoxx High Yield. Assets under management dropped 16% to $7.96 trillion in the three months ending Sept. New York-based BlackRock’s revenues fell 15% to $4.31 billion, missing the $4.33 billion expected from analysts surveyed by Bloomberg News. While BlackRock Inc.’s third quarter earnings and revenue slid in a difficult investing environment, the firm’s iShares exchange-traded fund business provided a measure of relief.

0 kommentar(er)

0 kommentar(er)